Procedure is required action to be followed: Procedure is the established way of doing something; a series of actions conducted in a certain order; and/or steps necessary to meet the terms of a grant agreement.

Guidance is supporting information or recommended action: Guidance consists of recommended best practices; helpful context; and/or tools, resources and examples.

Effective Date: 7/1/2025

I. Procedure

Accounting for staff time is important for budgeting, planning, and reporting. Recipients of BWSR grants have two options for tracking staff time charged to grants:

- Direct time tracking - recording hours spent on a daily basis.

- Personnel activity reports (PARs), summary of time at some greater interval. Activity reports must be prepared and signed at least semiannually by the employee.

BWSR reserves the right to request additional documentation that accounts for all of the employee’s time during the period that staff time is actually charged to the grant. Staff time not charged to the grant does not need to be itemized by activity and can be summarized in an all-inclusive “other” category of internal accounting systems.

BWSR will not accept position descriptions to account for staff time charged to BWSR grants.

Required time tracking procedures

Staff time charged to BWSR grants must be tracked or accounted for as it is reported in eLINK, at two levels:

- Grant - Grants must be identified by a grant title in order to distinguish the grant from others administered by the organization (for example, 2025-Local Water Management-NRBG, 2025-Conservation Delivery, or 2025 Watershed Based Implementation). BWSR recommends a naming configuration consistent with the grant title in eLINK.

- Activity category – Grantee must identify the eligible eLINK activity category based on grant workplan and/or grant agreement, such as:

- Administration/coordination

- Education/information

- Inventory/mapping

- Monitoring/data collection

- Planning and assessment

- Project development

- Regulations/ordinances/enforcement

- Technical/engineering assistance

Charges for staff time must be based on records that accurately reflect the work performed. These records must:

- Be supported by a system of internal control that provides reasonable assurance charges are accurate, allowable, and properly allocated.

- Be incorporated into the official records of the grantee.

- Be maintained for all employees whose time is being charged to the grant.

Staff time contributed as match must be documented, quantifiable, and able to be distinguished from staff time charged or used as match elsewhere. BWSR monitors the accuracy and allowability of staff time contributed as match.

II. Guidance for time and effort documentation

BWSR provides two direct time tracking system templates and two personnel activity reports (PAR) templates to assist grantees in documenting the time and effort they charge and report to BWSR grants. The templates are provided as examples and grantees are not required to use the templates. Grantees may develop their own time tracking systems or PARs in accord with BWSR policy, procedure, and guidance. Staff time used as match should be tracked by grant and activity category.

Example 1: Direct time tracking

Direct time tracking is recording hours spent on a BWSR grant on a daily basis, as shown in Figures 1 and 2 below.

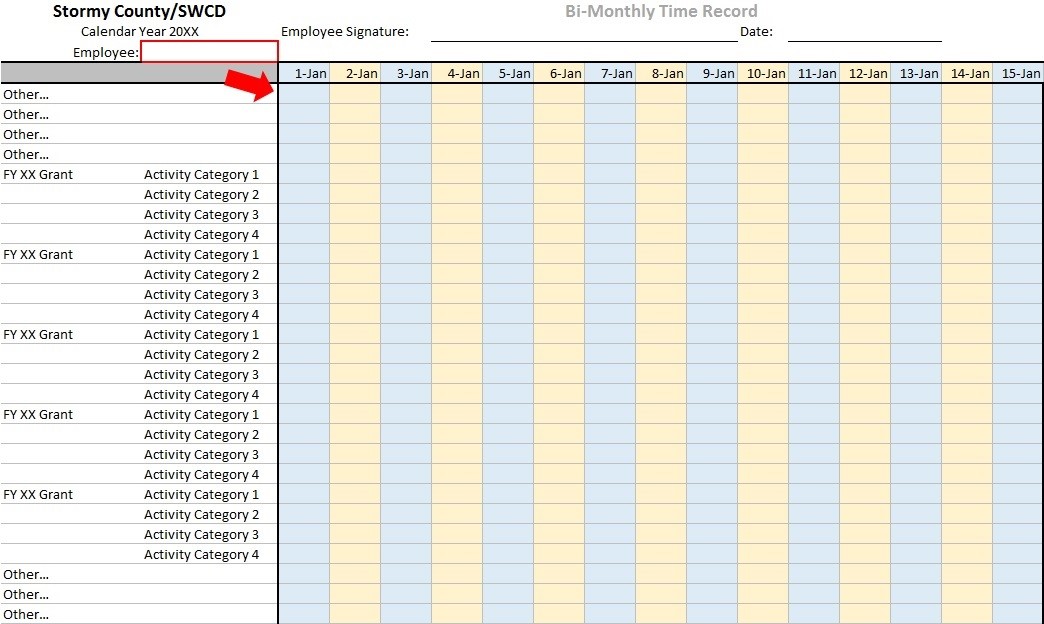

This spreadsheet template shown in Figure 1 below (or download .xlsx file from BWSR’s website) records the hours per day an employee (identified at the top of the sheet) dedicates to each of several BWSR grants during a bi-monthly pay period. Individual BWSR grants are identified and time is tracked to the activity category within those grants. Grants and activities are listed in rows, and hours tracked in columns. The template links each employee’s sheet to a summary sheet within the workbook that automatically calculates the amounts charged to grants for all employees.

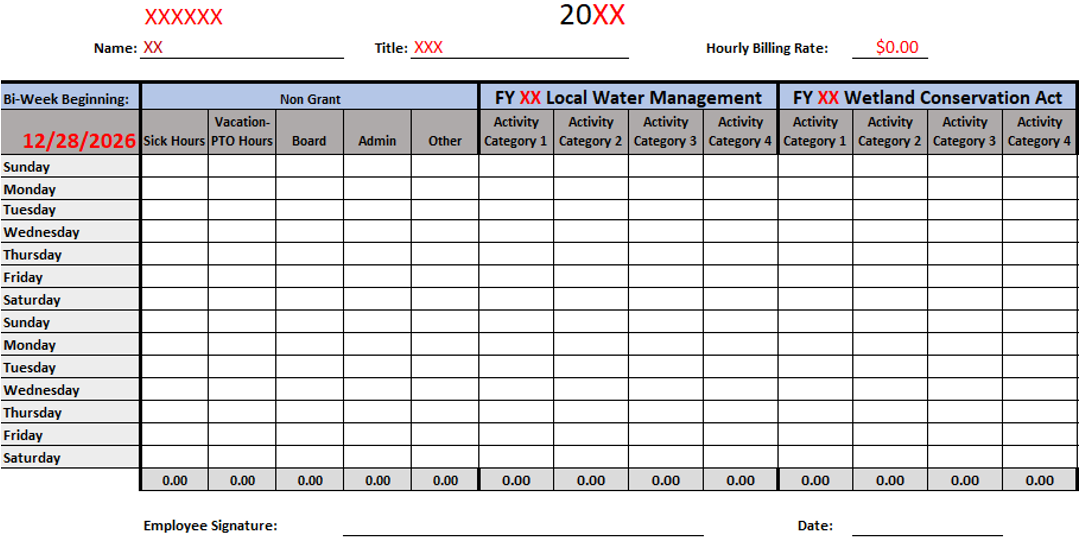

The bi-weekly spreadsheet template shown in Figure 2 below (or download .zip file from BWSR’s website) arranges the grants and activities where daily hours are assigned to in columns (across the top of the spreadsheet) rather than in rows. This template differs from the previous template in tracking the time of individual employees in separate workbooks rather than in separate tabs in the same workbook. Hours are summarized per employee, and multiplied against the billing rates of those employees, to calculate amounts charged to grants.

A database can also be used to track time. The advantage of a database is it can be configured to track time at several levels beyond grant and activity. Depending on the program or project, a database can also be configured to automatically assign an employee’s activities to the grant funding them.

Figure 1: Bi-monthly time tracking system, grants and activities in rows

Figure 2: Bi-weekly time tracking system, grants, and activities in columns

Example 2: Personnel activity report (PAR)

The second option for accounting of staff time charged to BWSR grants is a personnel activity report or PAR. The difference between the two options is that, while a direct time tracking system records time on a daily basis, a personnel activity report is a summary that records time at some greater interval after the fact. BWSR requires PARs be filled out at least semiannually, but it is recommended to be done on a monthly basis, per the following examples.

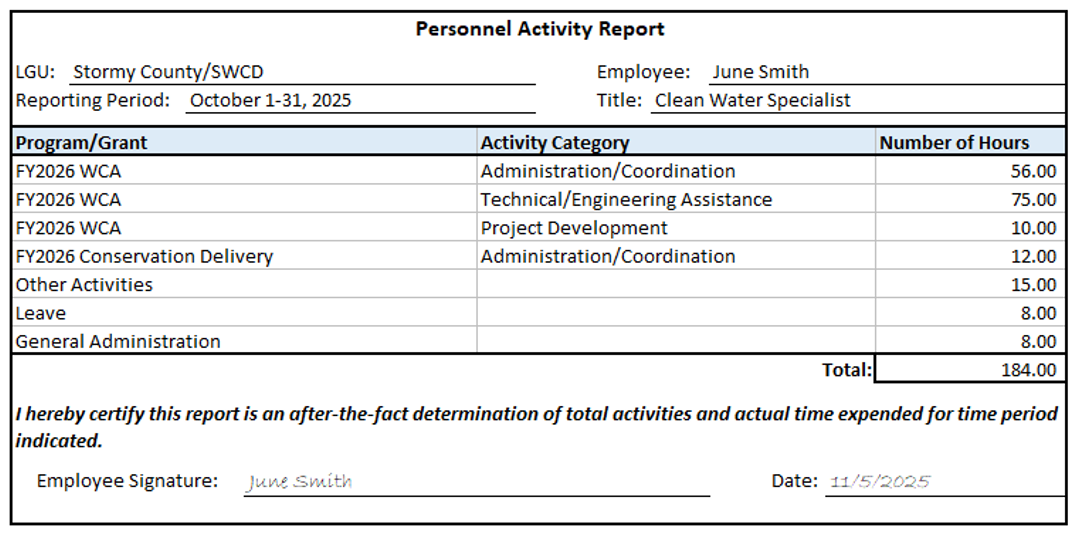

Figure 3: Personnel activity report (PAR), activity only

In this first example of a PAR Figure 3. above (or download .xlsx document from BWSR’s website), the employee records the time he/she is charging to BWSR grants on a monthly basis, and assigns it as required to both the name of the grant (for example, FY 26 WCA, FY 26 Conservation Delivery, etc.) and the activity category (i.e., administration/coordination, technical/engineering assistance, etc.). The PAR has a signature block for the employee to certify to the time reported. The PAR also includes rows for the hours not being charged to BWSR grants but may be included in a billing rate calculation: leave hours (vacation, holidays, or sick) and general administration hours (general administrative hours are not the hours directly charged to the “administration/coordination” of the grant itself). It accounts for all of the employee’s time during the month by documenting time dedicated to “other activities” not related to BWSR grants.

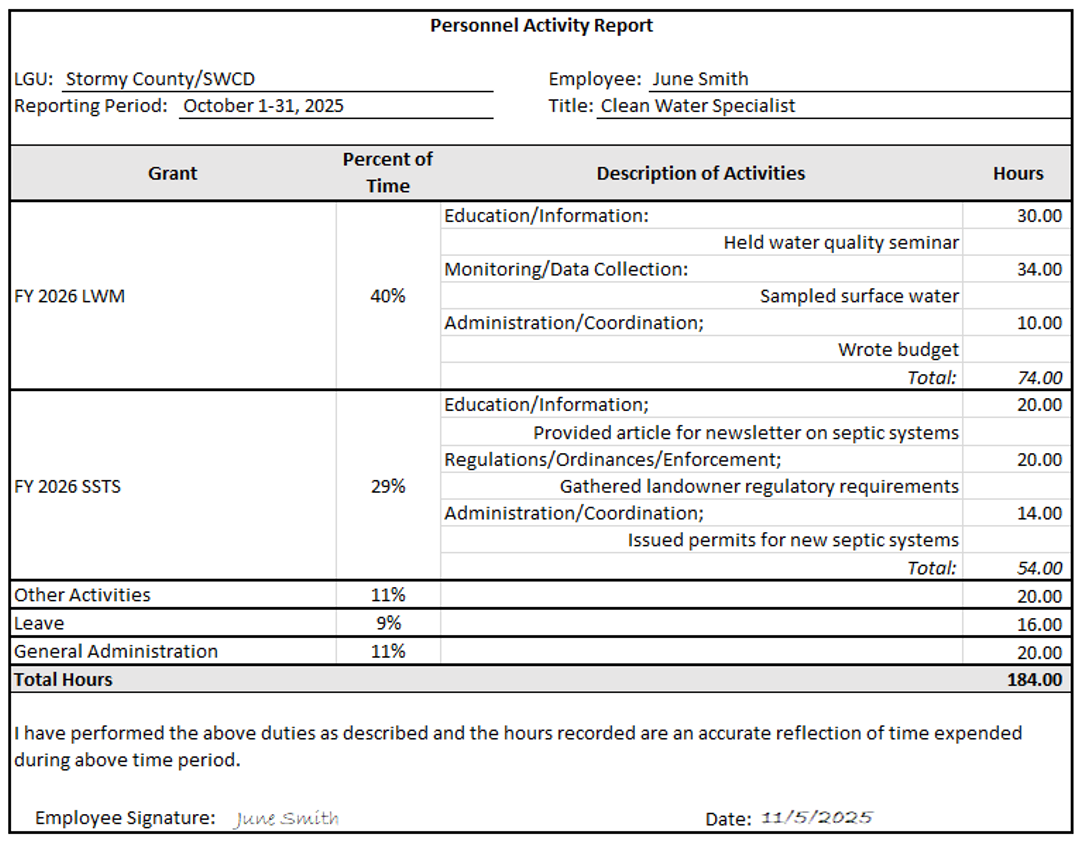

This second example of a PAR Figure 4. below records all of the information in the first example in a slightly different format (or download .xlsx document from BWSR’s website). It adds space for a description of the activity performed information that can be useful for submitting narratives of grant activities for the annual report required on the grant.

Both examples of PARs report time not only in number of hours, but also as percentages of the whole. Number of hours are necessary for calculating the cost of staff time, but percentages can be useful for budgeting or planning purposes. Budget estimates do not qualify as support for staff time charged to BWSR grants.

Figure 4: Personnel activity report, activity, and description

History

| Description of revisions | Date |

|---|---|

| Revised format; minor text changes for clarity. | 7/1/2017 |

| Removed dated reference of position descriptions. | 7/1/2023 |

| Reformatted chapter structure. Grant requirements have been moved to grant agreement, procedural requirements have been reformatted to provide additional clarity. PAR examples updated. | 7/1/2025 |